HSBC Originations

Designing a single channel account opening service for one of the world's leading financial institutions.

Challenge

At the initiation of the project, global conversion rates for current account openings stood at under 5% for HSBC, necessitating that applicants complete the application journey in a single branch.

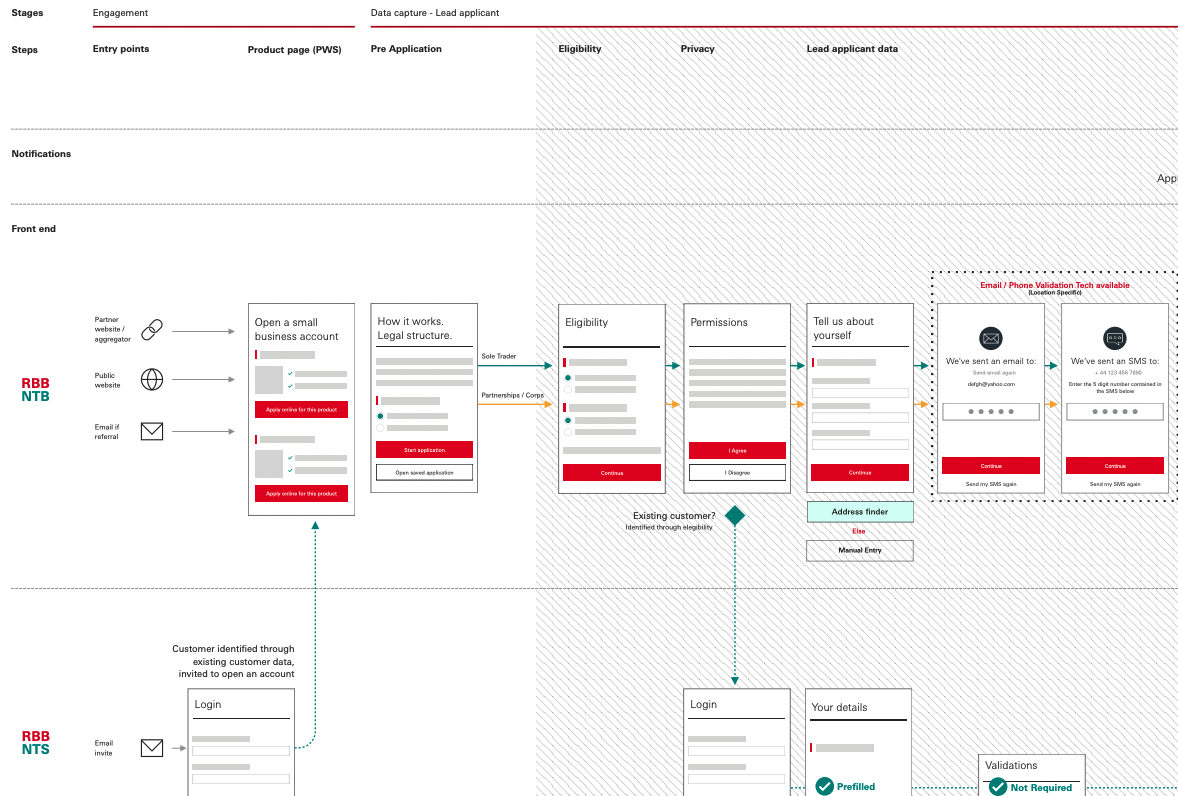

t In the face of competition from challenger banks and innovative fintech startups that were redefining customer expectations and enabling account opening in seconds, HSBC recognised the imperative to seek parity with these user experiences. This was a strategic priority to ensure its continued success in the sector. The proposed solution was to be initially implemented in Hong Kong, with the Global design subsequently being refined for universal implementation.

What we did

Discovery and research

The process of designing journeys for financial services is characterised by a number of distinctive challenges. Our preliminary research, which was primarily based on page analytics, suggested that users were inclined to abandon the pre-existing onboarding journey at key points of the process. Subsequent qualitative investigation indicated that users may have been daunted by the substantial volume of information required to complete the account application process.

Reducing cognitive load

In order to address the issue of customers abandoning the journey, the Customer Due Diligence Team was approached in order to investigate the possibility of reviewing and reducing the amount of data gathered during the application process. The auditing of the journey with this objective in mind enabled a reduction in the amount of data requested by almost 40%, while still ensuring the compliance with legislative and business standards necessary for account opening (KYC).

sdf.

sdf.

sdf.

sdf.

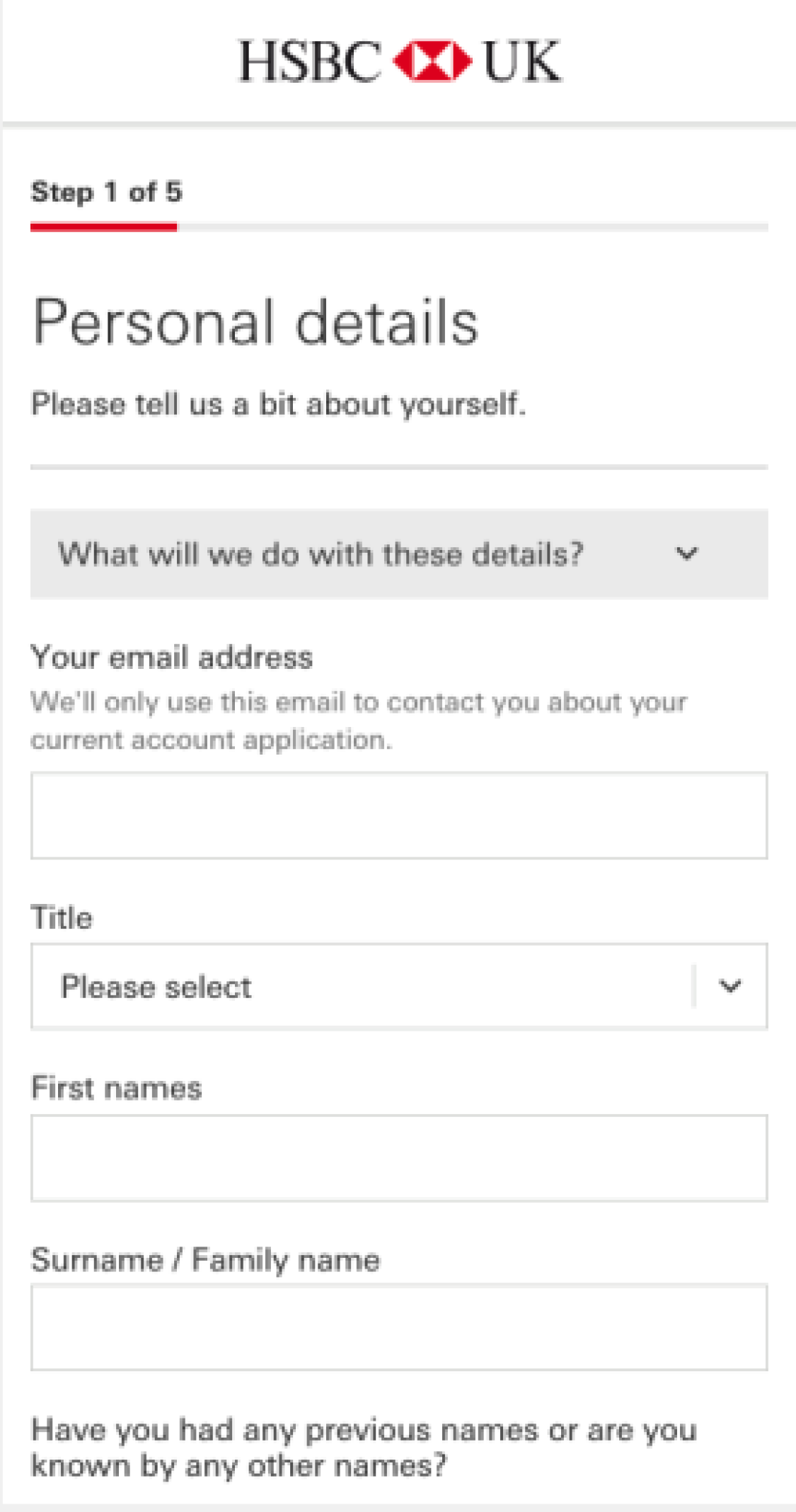

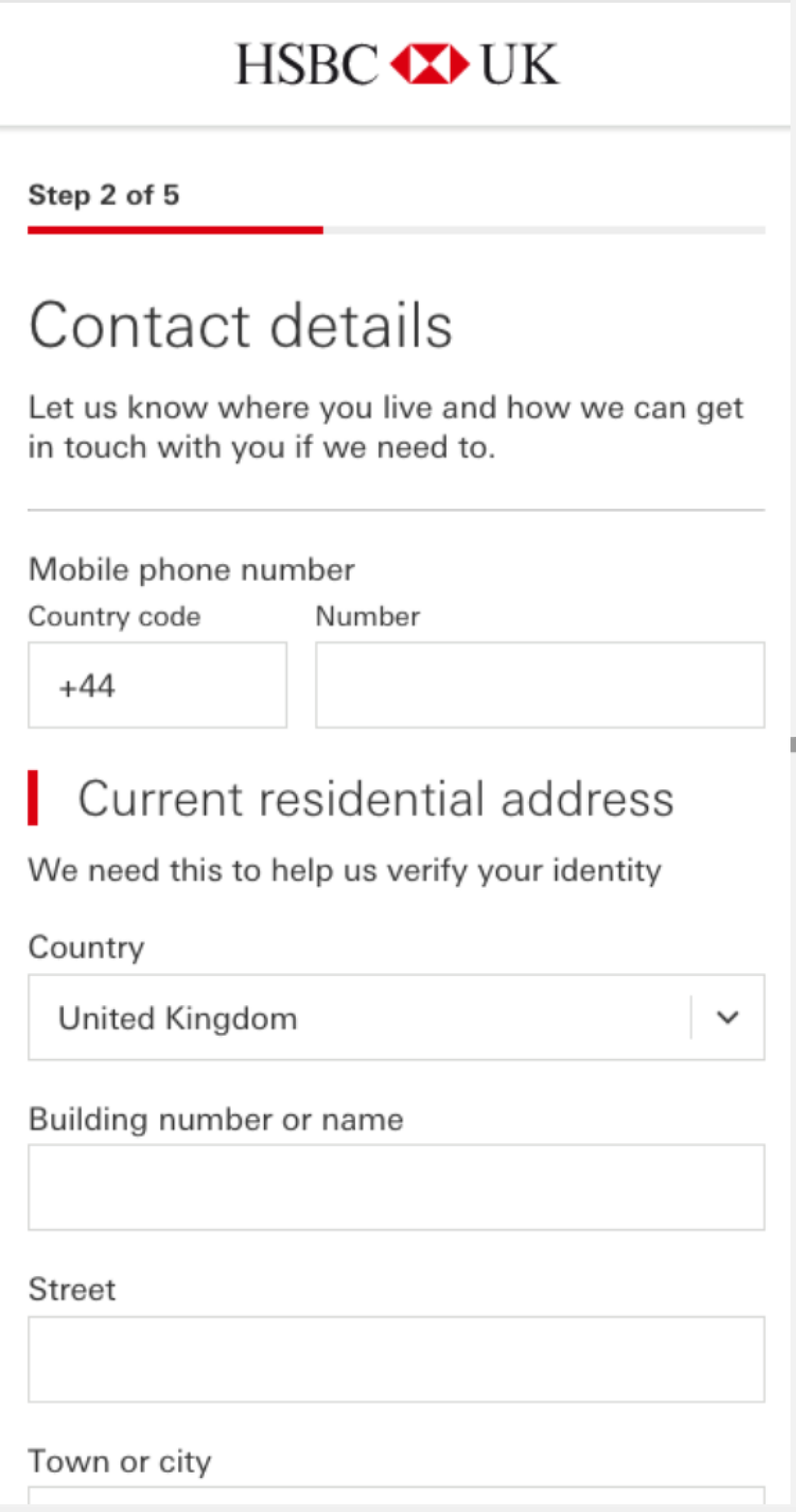

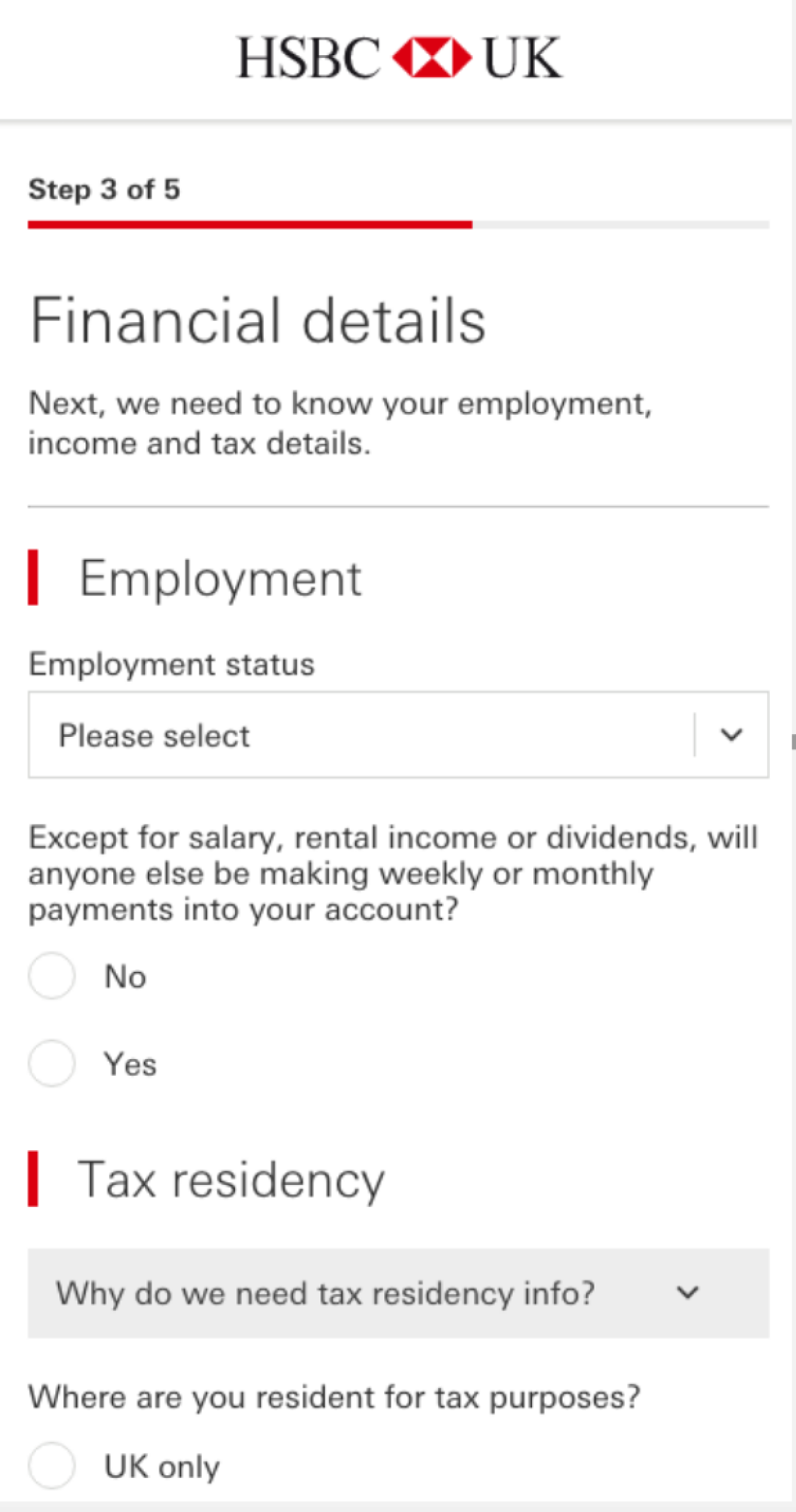

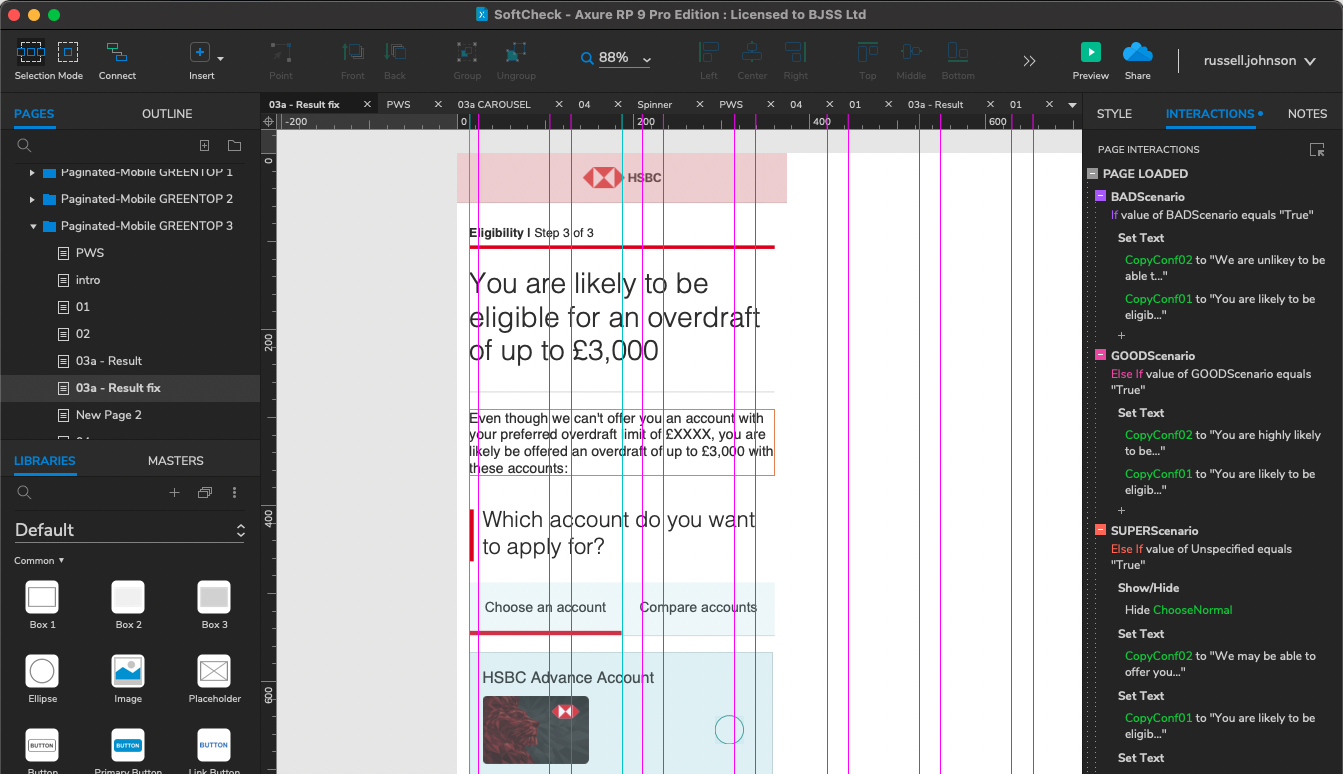

In addition, a 'progressive reveal pattern' was tested, whereby the presentation of questions to the user is based on the answers given to previous questions. It was found that the division of the question sets into discrete thematic sections (for example, personal, residential, employment, financial and account usage details) also had a measurably calming effect on users, who were then far more inclined to complete the application process.

Following the initial research phase, the design and development of live alpha versions of the service commenced. Sprints were utilised for the identification and resolution of technical, integration, usability and accessibility issues prior to the launch of the final product. This approach enabled the validation of our ideal user journey with a higher degree of fidelity, across multiple regions.

In an effort to reduce fraudulent behaviour, proprietary facial and ID documentation recognition features were implemented as part of the onboarding journey.

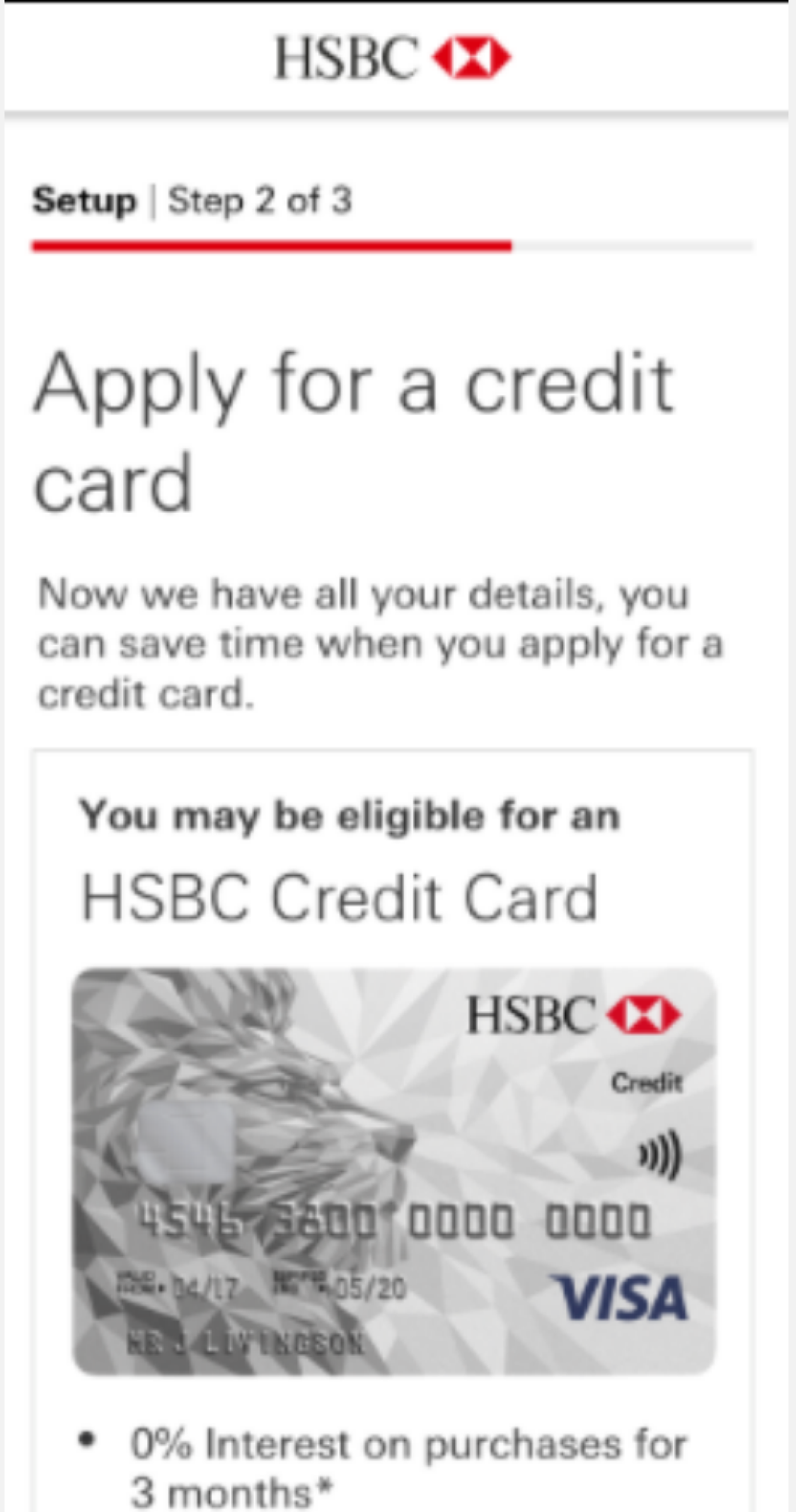

Using AxureRP to make fully clickable prototypes that allowed users to input parseable data

My role

In my capacity as a consultant at SPARCK/BJSS, I collaborated with permanent HSBC team members. My role was that of Head of Design for UK and HK Domestic Customer Onboarding. The responsibilities entailed:

Outcomes

Following the initiation of the programme, a uniform increase of 40% in conversion rates has been observed. Furthermore, the duration required to initiate an account has been diminished to approximately 12 minutes (it should be noted that the account opening process in-branch has the potential to extend to a duration of up to an hour, if not longer).